The Case For Outsourcing

COVID-19 Reflections & Future Implications

As the financial services industry adapts to working remotely and tests business continuity, Outsourced Services and Providers have supported firms through this transition. Across the spectrum from new launches to established managers, we saw the majority of funds migrate to a remote set-up by mid March 2020. Below are our insights from clients, service providers and allocators on how firms are leveraging Outsourced Services and Solutions.

Key Considerations: Why are managers leveraging Outsourced Solutions and Services?

Back-up solutions

Operational continuity

Disaster recovery planning

Optimize internal infrastructure

Further bolster existing continuity policies

Access to an experienced team

Address key-man risk concerns

Minimize cost and disruption

Short-term spikes in volumes

Balance front and back office execution requirements

Redundancy provision

Enhanced compliance

Regional coverage

Flexibility to scale up and down

Increased comfort from the ODD community

Future Implications for Outsourced Solutions and Services

Events in our industry can have lasting impacts on businesses and best practices. We saw rise in importance of third party fund administrators to be the independent books and records for funds post Bernie Madoff.

Outsourcing may be the next endeavor for business continuity.

30% of managers we polled recently said they were more likely to consider outsourcing solutions and services as a result of COVID-19.

Trends in Outsourced Trading

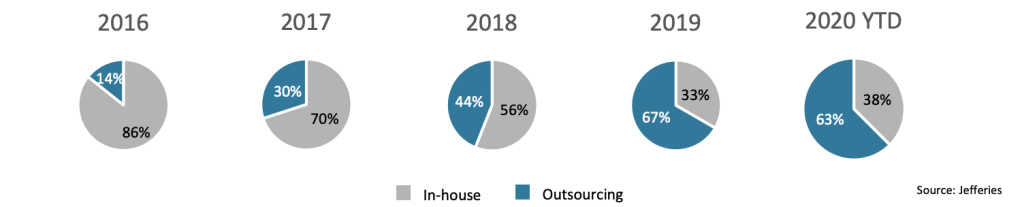

Jefferies has observed a growing trend in New Launch Hedge Funds choosing to outsource their trading function at launch.

But it’s not just start-up hedge funds leveraging an Outsourced Trading Desk. Established Firms use Outsourced Trading to back-up their own trading solutions, and further bolster continuity policies.

The Jefferies Outsourced Trading Desk observed a significant increase in client activity and handled more inbound calls and trades from clients than any other month since inception in June 2018.

50% of the trading activity that Jefferies Outsourced Trading Desk saw in the month of March was from Established Hedge Funds and Long Only Firms.

IMPORTANT DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2020 Jefferies LLC