Building Agile Organizations

Outsourcing for Institutions

The Covid-19 pandemic is prompting every organization to reassess assumptions about work, productivity and efficiency.

Pensions, endowments and foundations are no exception. With many of these institutions successfully working in a distributed environment, much thought and resourcing is being dedicated to ensuring any shocks going forward continue to be digested as seamlessly as possible – and taking lessons learned to date to build more agile firms going forward.

Outsourcing has become a central part of the discussion in evaluating long term solutions that can be deployed tactically or over time to minimize cost and disruption, bolster available resources or take advantage of market opportunities in unprecedented times.

This is the First ‘Truly Virtual Crisis’

Other than essential workers who must leave their homes to carry out professional responsibilities, at this point, most teams have created new normal that revolve around virtual connectivity. For many, some of the dimensions of this virtual connectivity include:

a. Virtual communication (via Teams, Zoom, etc.)

b. Navigating new human capital needs

c. Outsourcing operational and execution capabilities

We conducted an informal survey in April to get a sense of what teams successfully have in place now, what is in process, and what may being considered for the longer term

Resource Uptake in Virtual Landscape

| Type of Institution | Virtual Communication | Exploring New Human Capital Norms | Exploring Outsourcing Operations or Execution |

|---|---|---|---|

| Endowments | 100% | ||

| Foundations | 100% | ||

| Private Pensions | 100% | ||

| Public Pensions | 100% | ||

| Family Offices | 100% | ||

| Average | 100% |

Some of this is intuitive and has been well reported. Because of the ubiquity and ease of use for many video solutions, “meetings” have made some of the easiest transitions to this virtual world.

But what about newer solutions, and ones that were just starting to gain broad based traction and acceptance pre-Covid?

Outsourcing: Key Resources for More Agile Institutions

There are a number of mature institutions across the endowment, foundation, pension and family office spectrum that are exploring new implementation and execution tools, including outsourced trading solutions.

These discussions are prompted by a combination of:

- Material trading needs, but not enough to require full time and dedicated headcount

- Challenging work environments that limit the ability to ensure 24/7 connectivity (i.e.: the “kids, dogs & Bloomberg effect”)

- Growing importance of real time market data in volatile markets

- Operational Continuity and the idea that another firm understands your workflow or can step in seamlessly if needed is resonating with organizations strongly right now

- Need to balance front and back office execution requirements (trading, regulatory and compliance)

- Increasing optimize internal trading infrastructure through outsourced trading as primary or back up mechanisms

Percent of Institutions With Internal Operations & Execution Needs

| Type of Institution | % with Internal Execution or Operations Resources |

|---|---|

| Endowments | <15% |

| Foundations | <15% |

| Private Pensions | <5% |

| Public Pensions | <5% |

| Family Offices | <20% |

These are complex decisions, and there are a number of considerations for institutions to consider as they work to build more agile organizations.

Key Considerations for Institutions Considering Outsourcing Execution, Trading or Operational Capabilities

- Volume of transactions across portfolio – core positions, hedging, and idiosyncratic transactions (ability to handle overflow trading)

- Desire to scale up and back as needed during periods of acute stress or volatility

- Ability to navigate legal and regulatory considerations, balancing execution with back office and administrative requirements.

- Access of broader number of regions/time zones

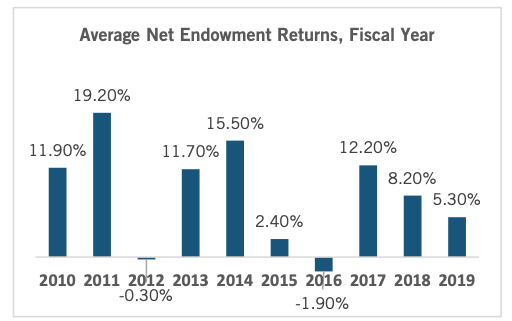

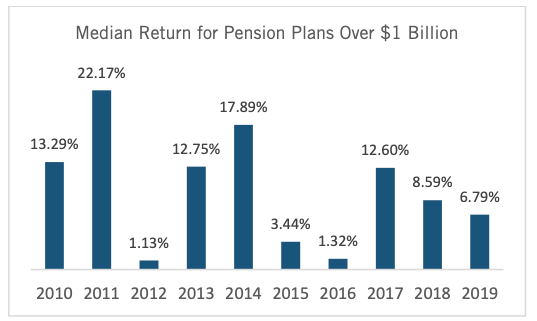

In the past, some of these institutions have leveraged “overlay funds” to assist with hedging or executing complex transactions. But in light of the Covid-19 pandemic and shifts in operating infrastructure, others are either revisiting or exploring outsourced options for the first time. Given variance in return profile over the last decade, outsourcing can serve not only as a source of operating efficiencies, but in some cases it may be more cost-effective over cycles as well.

Public pensions in the U.S. continue to struggle with meeting their long term commitments – as of 2019, Wilshire reports, state and local pensions are $4 trillion short of being fully funded.

The ongoing challenges for these institutions is driving renewed focus in operational efficiencies – many of which have been seen in a new light given the global work from home experiment during Covid-19.

Early Lessons Learned from Covid-19

In addition to revisiting potential benefits of outsourced trading or execution resources, the Covid-19 epidemic has shone a spotlight on two other ways to build more agile institutions: virtual communication and new ways of navigating human capital and talent questions.

We – and many others – have written at length to new norms around communication. Our Virtual Reality series covered:

- Internal conference calls and meetings

- External video conferences and client check ins

- ODD practices

Another way institutions are looking to build more enduring but agile institutions over the long run is revisiting some of the basic building blocks to their human capital strategy – in some cases outsourcing various responsibilities as a stop gap to when we can interview and vet potential coworkers in person – in others, to continue streamlining their operating footprint.

With many institutions trying to navigate the next 6 – 9 uncertain months, hiring processes are in a deep freeze (for the most part) and promotions, lateral moves and professional development have been put on pause as firms try to decipher how best to serve their current and future employees.

Key Considerations for Building a More Agile Human Capital Offering

A pause…yes. But many institutions have come to terms with the fact that we not only have successfully navigated a new set of challenges – but that the transition period “back to normal” will likely take weeks, months or even quarters.

As such, and because organizations no more want to become stale with their human capital efforts, a growing number are exploring ways to maintain and build a healthy, engaged and well-skilled workforce.

We have seen smaller firms successfully operate a more virtual model in recent years, but larger institutions are starting to look at potential benefits and efficiencies of operating a more agile workforce.

Potential benefits of self-directed work from home decisions:

- Higher productivity, as reported by Stanford researchers pre-Covid

- Fewer inefficiencies from commuting to/from work and to/from meetings – freeing up, on average, nearly an entire other work day per week

- Greater efficiencies of workforce: different time zones, for example, facilitate a more seamless “around the world” or “across the country” model

- More robust talent pools: as employers can cast a geographically wider net for the right person

- Lower costs of employment: as employers look beyond higher cost metro areas to fill roles

- More time and accessibility for skills building: as employees take advantage of employer-supported access to online learning solutions like Coursera

Robust human capital initiatives are critical to building strong organizations. And as we settle into a potentially prolonged transition period from quarantine and minimal interpersonal contact, a growing number of institutions are exploring how to optimize their employee footprints.

We have considerable data across the last ten weeks that virtual working does not necessarily have to reflect the downsides many employers formerly feared. And in fact – much of this remote work has been done under challenging circumstances like school closures and lack of child care that are unlikely to sustain post Covid-19.

Institutions are looking to use this transition period to assess what resources, strategies and tools can be leveraged to help build a more agile – and stronger – organization down the road.

Basic assumptions have changed, prompting a growing number of institutions to ask:

- Is my operating footprint optimized?

- Could I be building a more agile, efficient and enduring organization with new solutions that have grown in recent years?

- Are there resources I should be exploring or revisiting given they have been well tested in the current landscape and may make sense for my organization?

- How should I be thinking about my human capital initiatives in this transition period and going forward?

- Are there talent opportunities I can be taking advantage of?

- Are there synergies with talent pools beyond my immediate office location that should be explored?

- If we are saving considerable time by not commuting, could I be “up-skilling” my employees through online training or learning?

- On the flip side, are there mental or physical health considerations I need to be exploring given the unprecedented nature of the environment?

How Jefferies Can Help

We have fielded a considerable number of new inquiries from institutions wishing to explore many of the above topics, opportunities, questions and challenges – whether on the outsourced trading and operations front, or around talent and human capital questions. We look forward to sharing in your exploration, and assisting with any questions you might have as your institution works to build a stronger and more agile structure for the decade ahead.

IMPORTANT DISCLAIMER

THIS MESSAGE CONTAINS INSUFFICIENT INFORMATION TO MAKE AN INVESTMENT DECISION.

This is not a product of Jefferies’ Research Department, and it should not be regarded as research or a research report. This material is a product of Jefferies Equity Sales and Trading department. Unless otherwise specifically stated, any views or opinions expressed herein are solely those of the individual author and may differ from the views and opinions expressed by the Firm’s Research Department or other departments or divisions of the Firm and its affiliates. Jefferies may trade or make markets for its own account on a principal basis in the securities referenced in this communication. Jefferies may engage in securities transactions that are inconsistent with this communication and may have long or short positions in such securities.

The information and any opinions contained herein are as of the date of this material and the Firm does not undertake any obligation to update them. All market prices, data and other information are not warranted as to the completeness or accuracy and are subject to change without notice. In preparing this material, the Firm has relied on information provided by third parties and has not independently verified such information. Past performance is not indicative of future results, and no representation or warranty, express or implied, is made regarding future performance. The Firm is not a registered investment adviser and is not providing investment advice through this material. This material does not take into account individual client circumstances, objectives, or needs and is not intended as a recommendation to particular clients. Securities, financial instruments, products or strategies mentioned in this material may not be suitable for all investors. Jefferies is not acting as a representative, agent, promoter, marketer, endorser, underwriter or placement agent for any investment adviser or offering discussed in this material. Jefferies does not in any way endorse, approve, support or recommend any investment discussed or presented in this material and through these materials is not acting as an agent, promoter, marketer, solicitor or underwriter for any such product or investment. Jefferies does not provide tax advice. As such, any information contained in Equity Sales and Trading department communications relating to tax matters were neither written nor intended by Jefferies to be used for tax reporting purposes. Recipients should seek tax advice based on their particular circumstances from an independent tax advisor. In reaching a determination as to the appropriateness of any proposed transaction or strategy, clients should undertake a thorough independent review of the legal, regulatory, credit, accounting and economic consequences of such transaction in relation to their particular circumstances and make their own independent decisions.

© 2020 Jefferies LLC